First a note on the marketplace:

The top 0.1% (930 out of 1.2M) of companies employ about 30% of the workforce. These are organizations with over 10K employees and are relatively difficult to market to. However, when that market has been successfully penetrated, incredible revenues from volume are probable. A similar number of companies (934) employ between 5000 and 999 employees and constitutes an additional 6% of the workforce. You can see from these statistics why top tier companies are trying to penetrate the mid-market and straying away from old philosophies that only the Fortune 1000 was worth selling to. In total, about 40% of the total workforce are employed by organizations with over 1000 employees.

For HR vendors whose source of business is derived from employee volume (HRO vendors, traditional outsourcers like ADP and Ceridian, and many software vendors) increasing volume with fewer sales would be extremely attractive. In the right sales model, sales acquisition costs (incrementally per additional employee) could also be significantly less expensive.

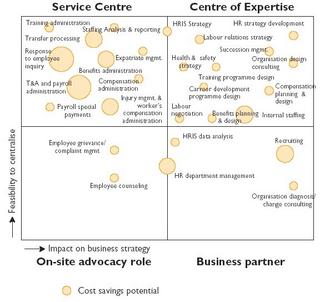

Below, I’ve graphically highlighted from HRMarketer’s published text. Unlike previous diagrams I’ve made, this is wholly agree with their categorization of the market. However, I’ll use it for illustration purposes.

(click for full size image)

I have also moved some of these “pillars” around as I see them. Granted I’m biased as a consultant, but indeed I think most of you would acknowledge that few vendors provide the strategic and objective expertise that a consulting organization will.

(click for full size image)

My simple view of the HR world is that HR organizations (with or without their consultants) need to navigate these “trends” that are occurring in HR. We see constant shifts in these trends, and senior HR management must determine which are useful to their organization. It’s also important to identify which trends have been recycled and re-branded. In many cases a “new” trend has indeed existed for some time and may have been implemented (unsuccessfully). Once the strategies have been formulated, the tactical data framework may be sought out. I separated outsourcing and HRMS from consulting because these are less advisory services, and more data services. For obvious reasons, HRMS and Outsourcing data services reside at a higher level than the point solutions. Once again, for the point solutions, I don’t agree with the categorization, but won’t change what HRMarketer has done for this purpose.